The Australian Government’s Consultancy Outsourcing Addiction

The PwC tax leak furore has drawn attention to the Australian Government’s consultancy outsourcing addiction. Decades of governments, at all levels, have overseen a huge exponential increase in consultancy contract work put out to the private sector for tender. “824,178 contracts were reported on AusTender with a start date between 1 July 2012 and 30 […]

Rents Are Choking the Australian Economy: RBA Policy Out Of Touch

The Australian economy is being ravaged by high rents and the Reserve Bank of Australia’s (RBA) monetary policy lever, raising interest rates is making things worse. Rentiers are not only landlords in the property sector, they exist in the mining, technology, and energy sectors as well. Indeed, this rentier economy is fast becoming the dominant […]

Australians and Their Money Are Easily Parted By Scammers

Imagine being famous for losing $3.1 billion to scams in 2022 and you will get a sense for how Australians and their money are easily parted by scammers. This new international reputation may not be something we want to be well known for. Aussies are falling foul of investment scams at record levels and questions […]

The International Banking Crisis: Are Australian Banks Safe?

“Something Wicked This Way Comes.” – Ray Bradbury There are economists and financially minded people predicting that bad things are coming. The international banking crisis has begun. The collapse of Silicon Valley Bank (SVB) was the result of a run on its deposits by customers and the bank’s inability to meet that demand. The first […]

Our Financial Data Security: Too Much Latitude For Cyber Criminals

Whilst watching the opening match of the 2023 AFL season, I noticed with some concern that the guernsey naming sponsor of the Richmond Tigers was Latitude Financial Services. I hoped that their defenders wouldn’t give the opposition too much latitude in the forward line. In light of the data breach via the cyber-attack on this […]

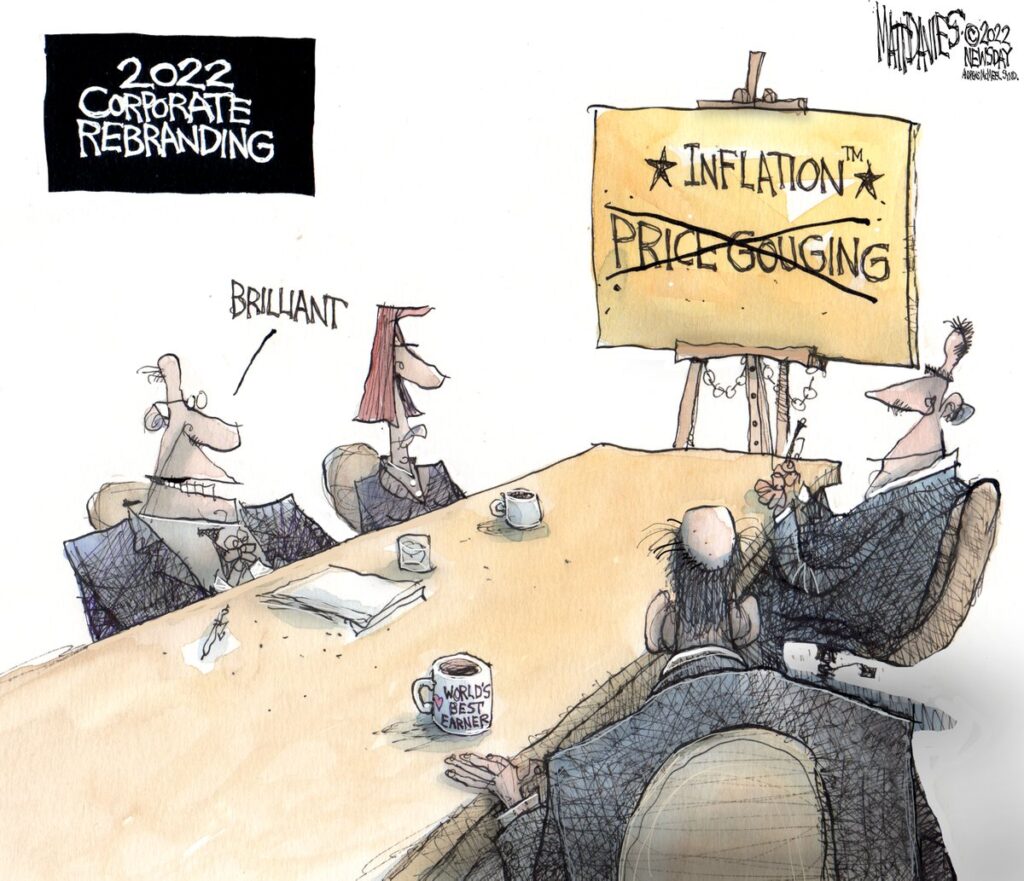

Australian High Inflation Driven By Corporate Profiteering

Economists have revealed that the high inflation rate in Australia is being largely driven by corporate profiteering. The rise in the Consumer Price Index (CPI) since the pandemic has seen prices for essentials like food, rent, and energy go through the roof. The inflation rate for the December quarter is at 7.8%. Analysis of the […]

Dealing With Debt: Our Economic Dependence On Credit

“Debt is the slavery of the free.” – Publilius Syrus Debt and indebtedness are very much the norm for most of us in the current clime. In fact, the modern economy runs on debt at all levels. We individual consumers are most likely in debt to banks and other financial institutions. Our governments are in […]

Matrimony and Acrimony: How Money Woes Beget Relationship Misery

What is the most common cause of relationship breakdowns? Infidelity? Abusive behaviour? Substance abuse? No, money problems are most often the root of all evil when it comes to ending happy couples. Matrimony and acrimony: How money woes beget relationship misery makes for thought provoking reading. Financial difficulties can lead to those other mentioned transgressions […]

The Failure To Educate Our Kids About Money: Oversight Or Something Else?

“Education is the most powerful weapon which you can use to change the world.” – Nelson Mandela We live in the twenty first century and our school curriculums are still turning out children woefully underprepared to meet the challenges of living in a complex economy. The failure to educate our kids about money: Oversight or […]

Comparing Australia’s Credit Rating Regime With China’s Social Credit System …

Can we compare Australia’s credit rating system with China’s social credit system? Yes we can … If you boil both of these systems down they are in large part about controlling the constituents of a nation. Capitalism controls via fiscal measures and totalitarian states have a few more levers to pull in making their citizens […]